Have you ever wondered why Medway is popping up on so many investors’ radars?

If you’re in the property game—or thinking about jumping in—you’ve probably heard whispers about Medway’s affordability, strong rental demand, and impressive growth potential.

Here’s the thing: those whispers are true. Medway isn’t just a great alternative to London; it’s fast becoming a hotspot for property investors who want solid returns without breaking the bank.

Let’s dive into what’s happening in the Medway property market right now and why so many people are calling it the South East’s hidden gem.

What’s the Buzz About Medway?

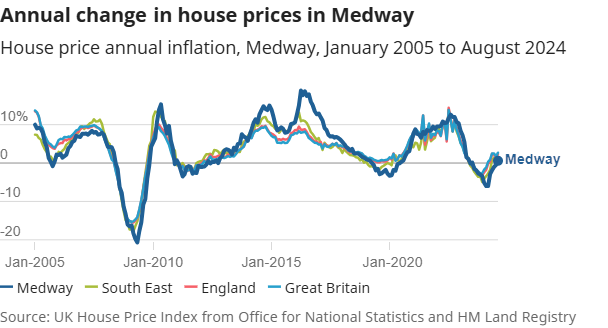

First off, let’s talk numbers but don’t worry, I’ll keep it simple. The average house price in Medway is £295,000.

That’s a fraction of London prices, yet the area is only 35-45 minutes away by train.

Whether you’re looking at buy-to-let, the BRRR strategy, or even HMOs, Medway offers a range of opportunities for savvy investors.

Why Medway is the Place to Watch

- Rental Demand is Booming

Renters are flocking to Medway. The average monthly rent here hit £1,120 in September 2024, up by a staggering 11.8% compared to last year. High demand = steady rental income for landlords.

Source: ONS Medway Property Data - Affordability Meets Growth

Medway’s average property price of £295,000 is accessible for investors, especially compared to London or other areas in the South East. Yet, it’s showing steady growth, making it a great option for both capital appreciation and rental yields. - Regeneration is Transforming the Area

From the Chatham Waters Project to new residential developments, Medway is undergoing a transformation. These projects are boosting property values and making the area even more appealing to residents and investors alike.

Why Investors Love Medway

Think about this: where else can you find affordable property prices, high rental yields, and proximity to London? Medway ticks all those boxes, plus it has the bonus of being a growing community with a mix of heritage and modernity.

Whether you’re a first-time investor or expanding your portfolio, Medway offers:

- Rental Yields: Averages of 5-6%, higher than many areas in the South East.

- Diverse Tenants: From London commuters to students and young families.

- Room for Growth: Regeneration projects are driving property values up.

How to Invest Smart in Medway

If you’re ready to take advantage of Medway’s market, here are a few tips:

- Target high-demand areas like Gillingham and Rochester. Look for properties near train stations or universities.

- Consider value-add opportunities: Run-down properties that can be refurbished for higher rents.

- Explore HMOs: With strong rental demand, shared living spaces can yield even higher returns.

Final Thoughts

Medway isn’t just a good property market—it’s a smart investment choice for 2024. Whether you’re after strong cash flow, long-term growth, or just a foot on the property ladder, Medway’s mix of affordability and opportunity makes it hard to ignore.

Thinking About Medway?

Let’s chat! Whether you’re curious about rental yields, regeneration hotspots, or just how to get started, I’d love to help. Drop a comment or send me a message—this could be your next big investment move!